*太长不看中文版* 因为中外文化的差别,有些国内的朋友认为先还房贷不如做理财更划算。大家可以根据自己的具体情况权衡。

1.除了基本生活费、退休投资和教育投资以外的钱都应该用于还房贷。

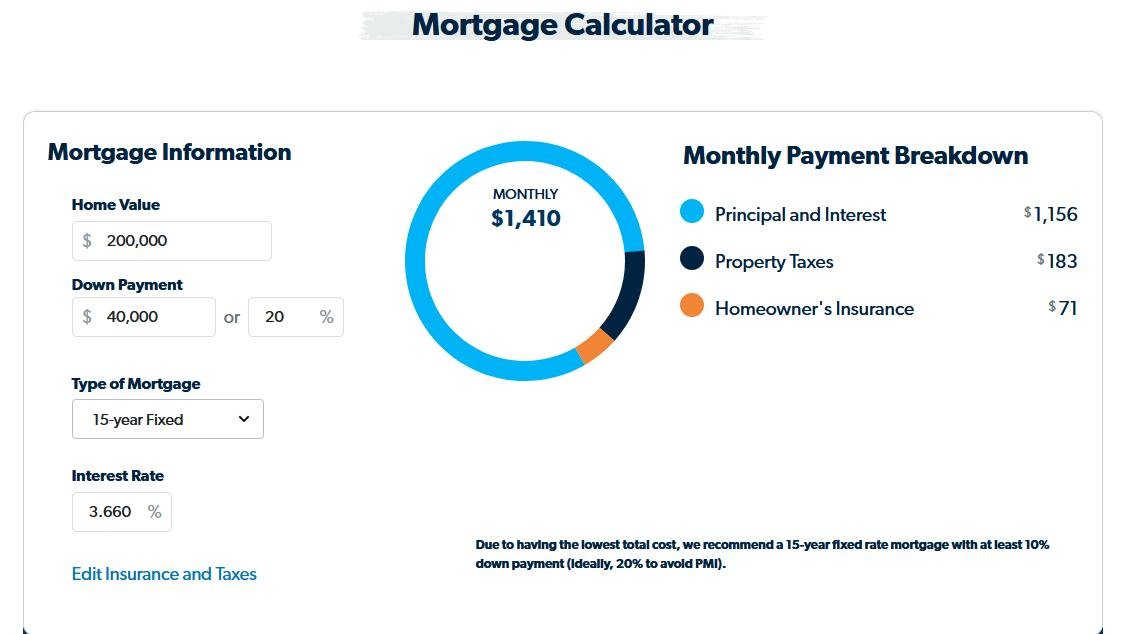

2.如何计算每月的付款

- 根据贷款年数(15年/30年)查出每贷款$1,000所需的利率

- 每月付款=(售价/1000)x 利率

3. 思考是否需要重新贷款

- 每月所省存款= 现在的本金和利息(不包括税和保险)-新的本金和利息

- 月数=房屋成交手续费/每月所省存款

- 如果将要居住的月数 > 计算的月数 —> 可以考虑重新贷款

4.15年按揭优于30年按揭;固定利率按揭优于调息按揭;每月付款应小于月收入的25%。

5. 房贷计算器

CHAPTER 11: PAYOFF THE HOME MORTGAGE

Key Concept #1:Start an Acceleration Payment Plan to Pay Off Your House Loan

- Baby Step Six: Pay Off Your Home Mortgage:EVERY dollar you can find in your budget above basic living, retirement investing, and college funding should be put into making extra payments on your home.

- How to Figure Your New Payment

1).Get the 15-year and 30-year rates for monthly payment per $1,000 in Loan Amount

2).Monthly Payment = (Sale Price/1,000) x Rate

- Should I Refinance? When refinancing, ask for a “par” quote, which means zero points and a zero origination fee.

1).Monthly Savings = Current Principal and Interest Payment (without taxes & insurance) - New Principal and Interest Payment

2).Number of Months to Break Even=Total Closing Costs / Saving

3).If you will stay in your home longer than the number of months to break even, you are a candidate for a refinance.

- Figure the change in your Adjustable Rate Mortgage (ARM).

Myth:

- It is wise to keep my home mortgage to get a tax deduction.

- I should borrow the maximum amount I can on my home (refinancing to get cash out) because of the great interest rates right now – and then invest the money at a high rate

- I would be smart to take out a home-equity loan as my “emergency fund”.

Truth:

- A fifteen-year mortgage is better than a thirty-year mortgage.

- It’s better to have a fixed-rate mortgage, even if the rate is higher, than to have an adjustable-rate mortgage( ARM) or balloon mortgage.

Key Concept #2:If at All Possible, Pay Cash for Your House

- What I DO tell people is that they should never take more than a fifteen-year, fixed-rate loan, and that their payment should never be more than 25% of their take-home pay.

- Mortgage Payoff Calculator:Use our mortgage payoff calculator to see how fast you can pay off your mortgage! Just enter information about your mortgage loan and how much extra you plan to pay toward your principal balance.

读书笔记的思维导图:

结合书和练习册一起看,思路更清晰。(亚马逊上略贵,可以在一些二手书网站上买旧书更划算)。

君君提示:你也可以写原创长文章,点此查看详情 >>

本文著作权归作者本人和北美省钱快报共同所有,未经许可不得转载。长文章仅代表作者看法,如有更多内容分享或是对文中观点有不同见解,省钱快报欢迎您的投稿。